Loans & leases remain on a significant uptrend in July. What's more, the improvement is widespread with both consumer and commercial & industrial loans showing sizeable increases.

Jul 29, 2014

Jul 23, 2014

#China - Stock market looks good on the upside - Especially with so many bears around!

Everybody I talk to has a bad story on China.

Source: Stock Charts

The chart however suggests that the Chinese stock market is ready to go up. When a stock market is deeply oversold and nobody wants to invest anymore most likely a lot of money can be made!

Bears are fascinated with China & yet the market isn't falling…

When discussing risks in the global economy and macro investments, majority of the fund managers agree that China is the biggest worry and one majority lose sleep over. The bearishness has actually been intensifying over the last few years, and yet the Chinese stock market has actually failed to fall lower. Volatility has completely died out in 2014 and it seems a big move is coming soon.

The truth is, Chinese mainland stock market is incredibly oversold. After peaking in 2007 at around 6000 points, the index finds itself 66% lower 7 long years later. Furthermore, since 2009, Shanghai Composite has failed to staged a multi-quarter rally. Constantly bombard by bad news and a sideways trending market, investors have surely forgotten that Chinese stocks can actually go up, too.

Jul 1, 2014

The Press Keep Talking The Market Down – Historically this is Very Bullish Indeed

The Press Keep Talking The Market Down – Historically this is Very Bullish Indeed

Posted on June 30, 2014 by Martin Armstrong

I have warned about how the press had constantly written negatively about the rising stock market during the 1920s. Once again, the press are now hanging on the hope that the Fed will start to raise rates to justify their bearish bias swearing the market cannot be justified at these highs. However, I have shown the evidence that a bull market ALWAYS rises with rising interest rates and declines with dropping interest rates. These people who think markets will decline because of a rise in rate repeat the same propaganda they have never once investigated or bothered to check the facts. If you think the market will rise by 25%, you will borrow at 10%. You will not borrow at 0.1% if you do not believe the market will rise at all – i.e. Japan for 23 years.

Sorry, but the Fed DOUBLED interest rates from 1924 into 1929. The Wall Street Journal accused Jesse Livermore of trying to influence Presidential elections back then for they could not understand that there were international capital flows pouring into the USA. This domestic analysis is simply lethal.

True, in the past week, James Bullard, president of the St. Louis Federal Reserve bank, told Bloomberg News that the economy was improving enough to handle an increase in short-term rates next year. The Fed fears that unless they raise rates, they will have no leverage when the economy turns down. The Fed is not entirely convinced about the negative interest rate scenario put forth by Larry Summers.

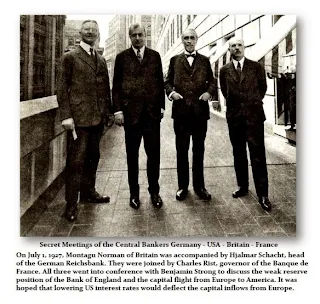

The press will go nuts when stocks rise with rising interest rates. In 1927 there was a secret meeting where the USA tried to lower its interest rates to deflect the capital inflows from Europe that was creating a shortage there and set the stage for the defaults in 1931. History is repeating. US and UK rates will rise while Europe will go negative. This will set the capital flows to the USA and may yet create a bubble top.

If we see rising US rates, the dollar will rise and capital will flow to the USA especially when smart money begins to realize that the IMF solution is to freeze all public debt in Europe so you cannot liquidate and/or seize everything in the pension funds. Once you extend 30 day government paper into 10 year, how do you sell anything next year? These IMF solutions are made by lawyers who are brain-dead with zero understanding of the credit markets or human nature.

We may be seeing history repeat again like an old record that is scratched and cannot move forward. So welcome the press and their perpetual talking down the market. As long as they keep this up, we are nowhere close to a major high.