If you are playing the odds, this is actually a good time to buy the dip if you haven't done so already.

From Ecoinometrics - March 08, 2021 - ecoinometrics.substack.com

The fact that Bitcoin seems to keep up with the rise of interest rates is definitely a good sign. This means that adoption remains the main driver of this cycle.

If you believe that to reach its natural market size (physical gold) Bitcoin has 10x more to grow then you aren't worried about the temporary rising yield situation.

I'm saying temporary because you have to guess that the Fed will have to do something at some point. By something I mean implement some form of yield curve control.

Apparently we aren't there yet. But if rising yields start causing serious problems for mortgages or trigger a new stock market crash then you can bet that as usual the Fed will act.

Let's monitor and see how this plays out.

Drawdown

I've just said that Bitcoin is doing fine in the face of rising bonds yields but it is true that we are still in a drawdown.

Of course drawdowns are not unexpected in a bull market.

Every time you get a sharp rise in price some people will take profit, you'll get a temporary correction and then we'll be back up until traders are exhausted again.

That's a natural function of the market, it doesn't mean that the bull phase of the cycle is over.

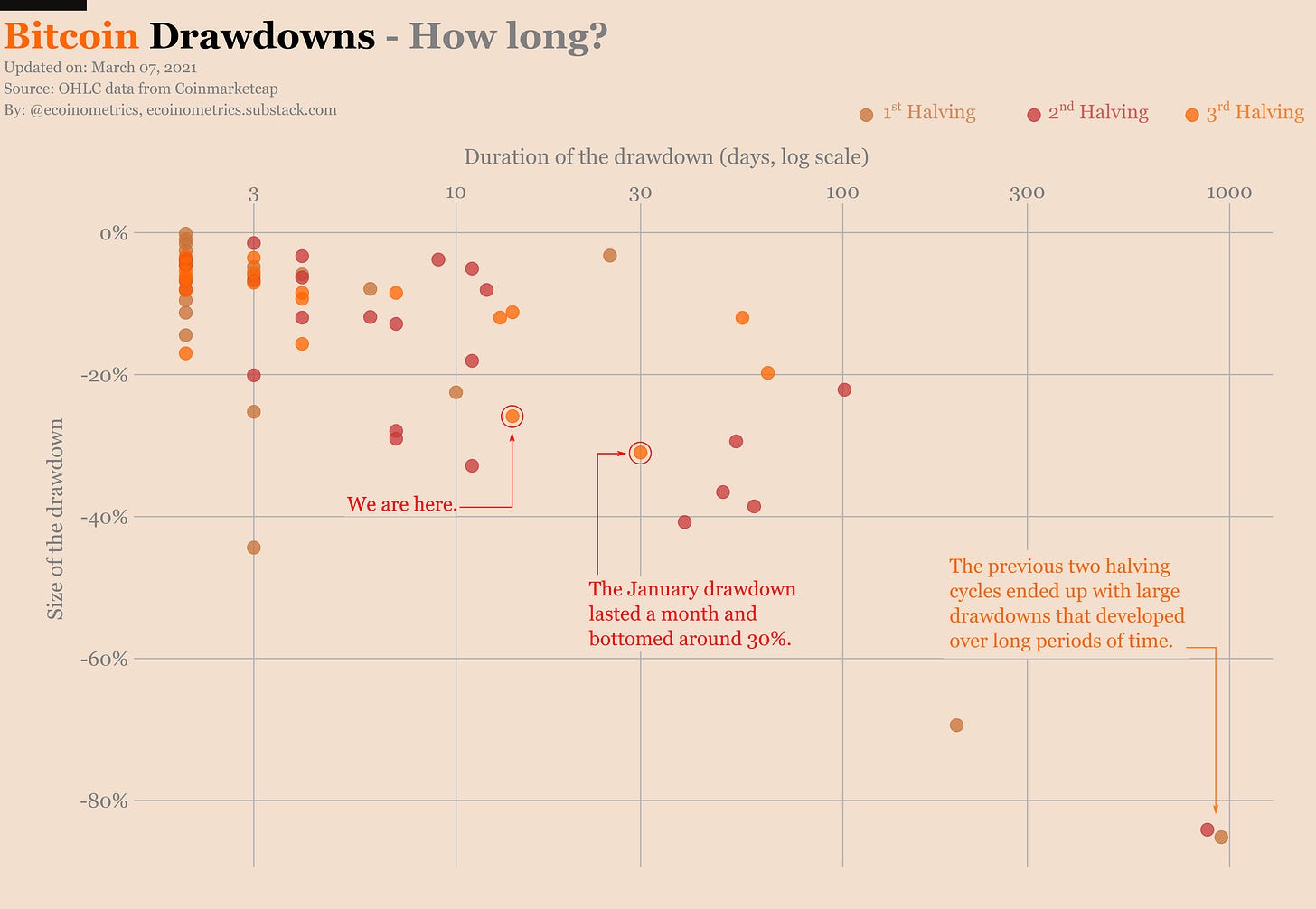

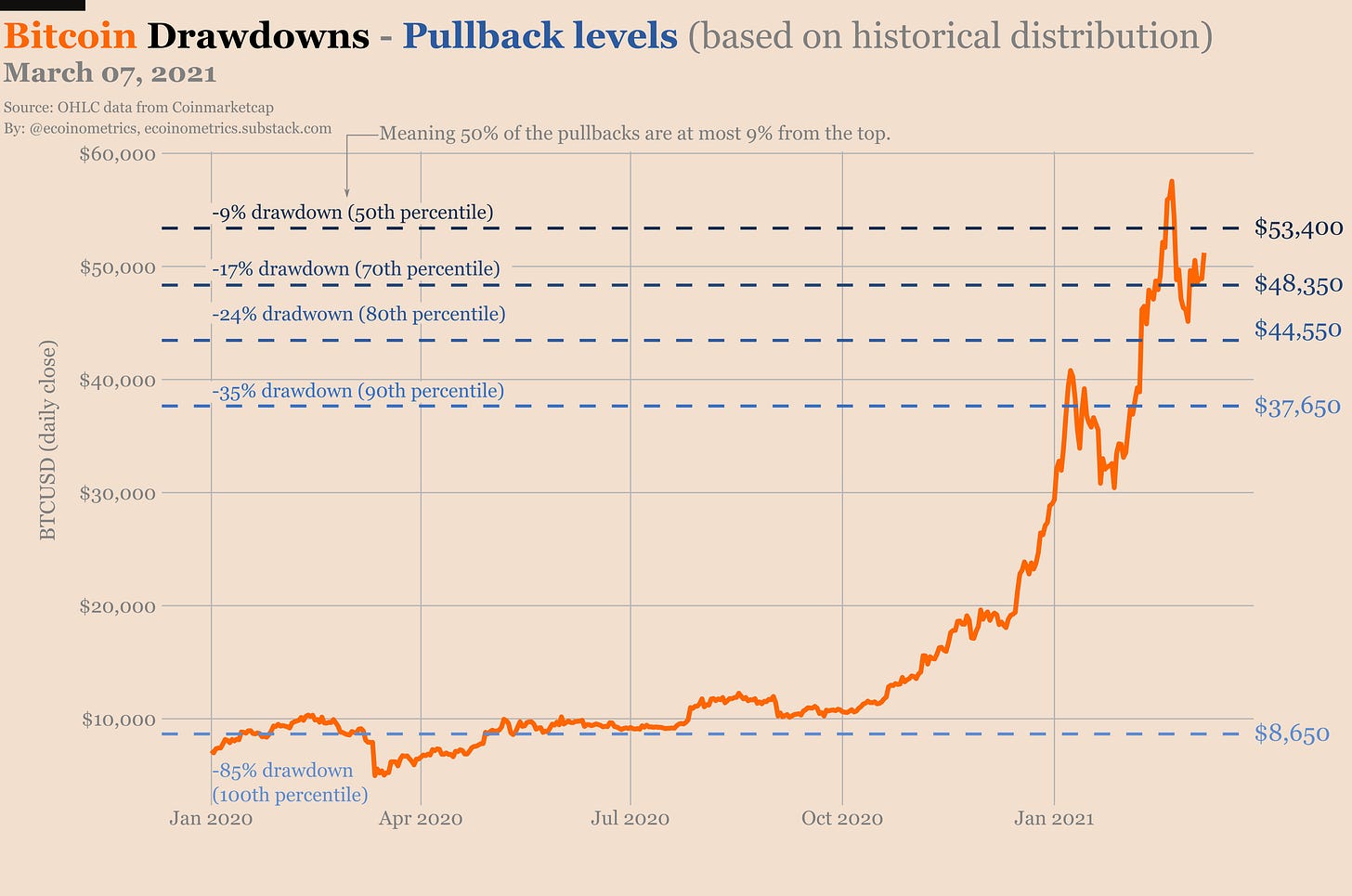

In that regard this dip is typical of what we have seen in previous bull markets:

A 25% drop that has so far lasted 15 days.

The last one in January was 30% and lasted a month.

As you can see on the chart below drawdowns in the 20% to 40% range can last anywhere between a few days to 3 months. So if you look at the stats and think about the fundamentals there is really nothing to be worried about.

https://ecoinometrics.substack.com/p/ecoinometrics-march-08-2021

No comments:

Post a Comment

___________________________________

Commented on The MasterFeeds