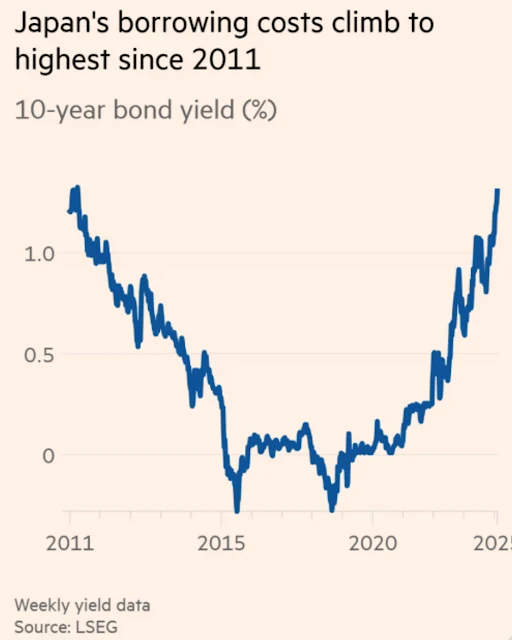

Rising interest rates, sustained inflation and potential wave of wage increases this spring are fueling relentless sell-off in Japan's government debt, bringing 10-year Japanese government bond yields to 1.31% Friday, after this year's rise of 0.21 percentage points, and a big jump in 2024.

Core inflation in December rose 3%—fastest annual pace in 16 months.

"[For Japan] inflation is for real this time," said James Novotny, an investment manager at Jupiter Asset Management.

Speculation is intensifying that the BOJ could raise rates in July and that the terminal rate might be higher than 1 per cent currently expected. —You can be sure it will be!

See the article in the FT here:

Japan's borrowing costs soar to 14-year high

___________________

No comments:

Post a Comment

___________________________________

Commented on The MasterFeeds